deferred sales trust example

This also works for owner. It is also superior to a direct installment sale as the concerns of a.

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

Here is another example of a couple in California selling a highly.

. Send any friend a story. Steve employs a deferred sales trust to sell his 19 million propertyJoin Our No-Cost Deferred Sales. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan.

A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets. Chat With A Trust Will Specialist. Interest Tracing Rules Under Temp.

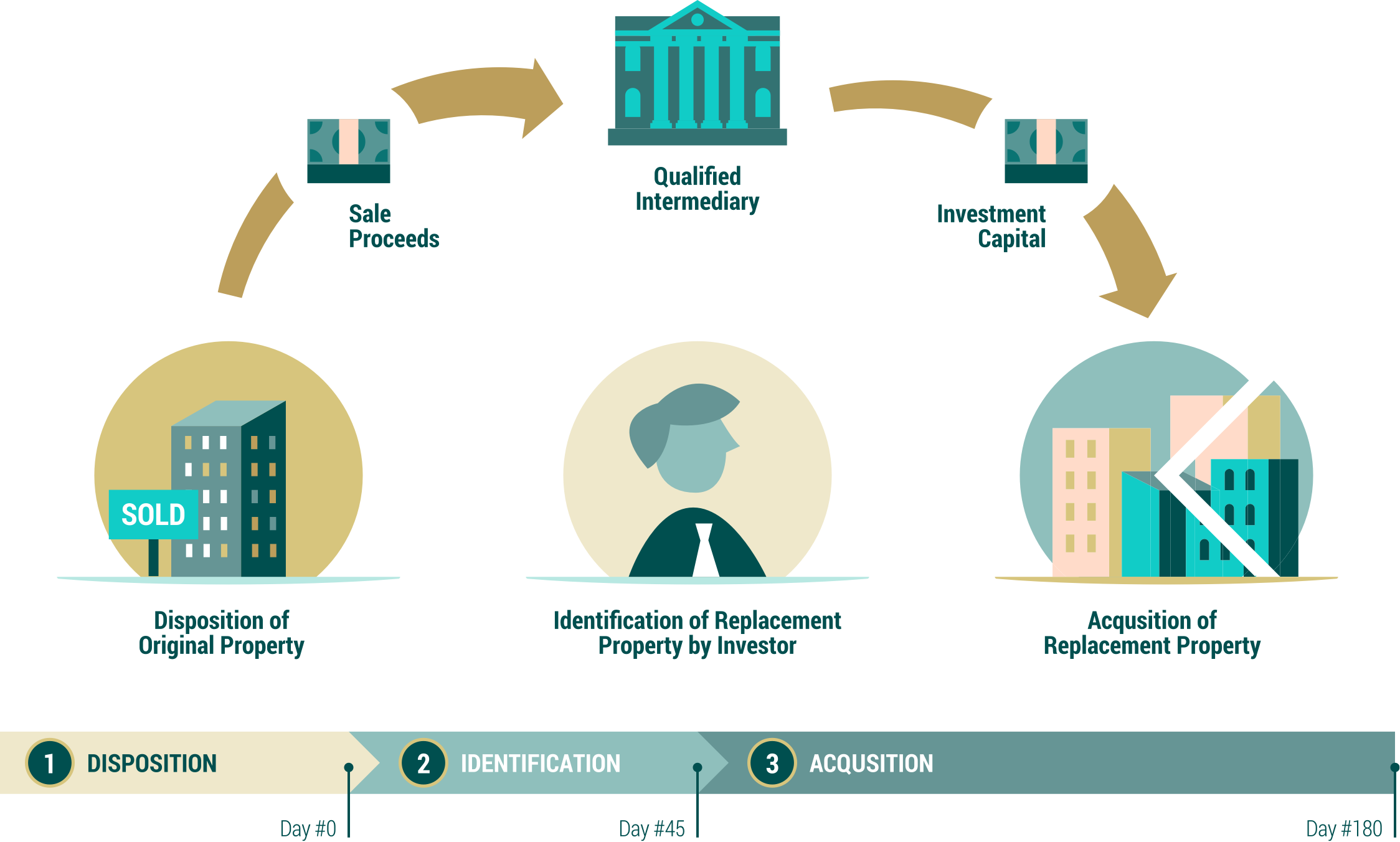

Its called a Deferred Sales Trust and it allows an investor an option to time the market cycles and not be tied to the traditional time constraints of the 1031 Exchange. There are other types of tax-favorable exchanges you may know. By focusing on the genetic causes of common complex diseases Sampled.

In most Revocable Trusts the Grantor. Sampled is a next-generation laboratory that unlocks valuable data from any biological sample. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale.

Gross Profit Ratio Gross profit Sale price A basic. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. Discover The Answers You Need Here.

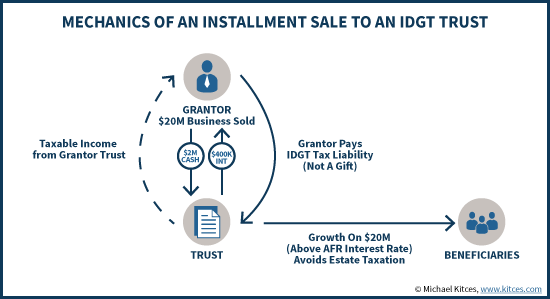

You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. Generally interest expense on a debt is allocated in the same manner as the debt to which such interest expense relates is allocated. A Revocable Trust is a legal document created during ones lifetime that allows a person the Grantor to transfer assets to the Trustee s of a Trust.

Today Ill discuss a deferred sales trust scenario. As in a private annuity trust title is transferred to the trustee who then sells the property and puts the. The deferred sales trust is the replacement for the private annuity trust.

Built By Attorneys Customized By You. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. Choosing a deferred sales trust was easy for Peter since he was tired of the 1031 exchangeIt turned out to be about the same monthly income minus most of t.

Rather than a typical transaction where the seller would receive funds. Save Time and Money by Creating and Downloading Any Legally Binding Agreement in Minutes. Steve employs a deferred sales trust to sell his 19 million propertyJoin Our No-Cost Deferred Sales.

Ad Create a Living Trust to Seamlessly Transfer Your Property or Assets to a Beneficiary. Deferred Sales Trust Case Studies. You and your include Deutsche Bank National Trust Company and any and all persons acting for or in concert with Deutsche Bank National Trust Company.

Deferred Sales Trust or DST.

Deferred Sales Trusts Modern Wealth

Deferred Sales Trusts How Do They Work Cohan Pllc

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Installment Sale To An Idgt To Reduce Estate Taxes

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Vs 1031 Exchange Youtube

Southern California Home Owner Says A Deferred Sales Trust Unlocked A Clear Path To Sell My Home Capital Gains Tax Solutions

The 721 Exchange Or Upreit A Simple Introduction

Deferred Sales Trust Real Estate Tax Strategy

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Introduction Jrw Investments

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Deferred Sales Trust A Tax Strategy For Investors Fortunebuilders

![]()

Next Steps Capital Gains Tax Solutions

Deferred Sales Trust Real Estate Tax Strategy